|

On the 1st, March 2022 the LEI ROC (Regulatory Oversight Committee) issued new CDF (Common Data Files) Formats. LEI Worldwide have implemented the changes in its RAMP LEI management platform. RAMP is a proprietary software tool used by Financial Institutions such as Banks, Asset Managers, Fund Administration firms who manage large portfolios of LEIs. RAMP makes it faster and easier to obtain LEIs and maintain oversight of an LEI portfolio. LEI Fund Structure ReportingOne of the significant changes to LEI data reporting is that complex Fund structures will now be able report their structure in a more transparent manner.

Funds are required to have an LEI under a litany of global regulations such as the European Union Directive on Alternative Investment Fund Managers (AIFM) and United States regulations such as the US Dodd-Frank Act Title IV. In the Policy issued by the LEI ROC titled “Policy on Fund Relationships and Guidelines for the registration of Investment Funds in the Global LEI System” the RIC state that a significant proportion of entities that have an LEI are investment funds. The report describes a “limited update to the way relationships affecting investment funds are recorded in the Global LEI System (GLEIS), with the objectives of making sure that the implementation of relationship data is consistent throughout the GLEIS and providing a means to facilitate a standardized collection of fund relationship information at the global level.” The updates allow for more detailed relationship data between entities under the entity types of ‘Fund Management Entity’, ‘Umbrella Structures’ and a ‘Master Feeder’ fund. The new features for adding Fund structures are not and have not yet been implemented by all LOUs or LEI issuers. This means that at the time of LEI renewal Funds may need to consider moving their LEIs over to a provider that caters to this new policy. Please complete an LEI transfer request here to move your existing LEI over to RAMP which will facilitate the new requirements. Other changes made in the CDF file formats, not related to Funds, is Legal Entity Events have been added, Government entities can report their structures and also entity creation date is a new, and highly important field for all entities applying for an LEI. Most of the new data will be added to existing LEI at the point of annual LEI renewal, thus the GLEIF have appointed a period of one year to update the system with the new fields and requirements.

0 Comments

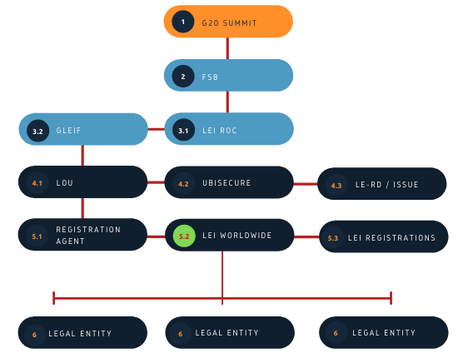

The Legal Entity Identifier (LEI) is a 20 digit corporate digital identifier that helps us accurately and quickly verify the identity of any company. An LEI code is reported by regulated counterparties to financial transactions to clearly identify ‘who is whom’. The LEI is backed by the G20 Nations, Financial Stability Board (FSB), openly supported by institutions such as the European Central Bank and the Bank of England. It is also an official ISO standard 17442.

Enter the vLEIThe introduction of Digital Certificates (e.g SSL), were a step in the right direction towards providing security around who is safe to do business with online. However they also fell slightly short of the mark when it came to having up to date, unique, current and high quality data. The vLEI has the potential to become one of the most valuable digital credentials in the world; it will be the hallmark of authenticity for all legal entities everywhere.” - GLEIF The vLEI is an adaptation of an LEI which is based on a verifiable credential. The vLEI is a fully digitized form of the LEI which enables instant and automated identity verification between counterparties operating across all industry sectors, globally. Based on a concept known as self-sovereign identity (SSI), the vLEI will be applicable to be embedded with most blockchain applications and none more perfectly suited to that of a Central Bank Digital Currency (CBDC). What is a CBDC? With the rapid digitisation of the global economy new innovations are surfacing which unlock pain points and replace outdated processes. Sometimes these innovations fit together perfectly, in this case we will look at the applicability of the LEI acting as the KYC layer to Central Bank Digital Currencies.

LEIs help businesses link data sets, improving analysis. Building a complete picture of a business, by linking its data, could also help small businesses to access finance. We will champion the LEI as a globally recognised identifier for all businesses in the UK." - Bank of England A Central Bank Digital Currency (CBDC) is essentially the digital form of a country's fiat currency, which is regulated by its central bank. B2B based transactions are currency only identified using the LEI in a regulated setting, but now that we have automated LEI issuing technologies such as RAMP 2.0 we can swiftly and easily roll out LEIs to all companies engaging in all financial transactions. Any CBDC would want to roll out LEIs to their clients in a worldwide manner, and RAMP 2.0 is the only RA model software capable of doing so on such a global basis. The Bank of International Settlements (BIS) released their CBDC for cross border payments last year and listed the Legal Entity Identifier as a means to standardising digital identity for legal entities. The Problem

The SolutionCBDCs are currency created without debt, this delivers the attendant benefits that do not exist in the current paradigm.

It is also a currency based on a blockchain system which is a fully traceable and auditable system. A CBDC currency can be programmed to be spent in accordance with behavioural economics. Incentivising some behaviours, disincentivising others in order to stimulate the economy and prevent so called dirty money from entering the system. A CBDC based cross-border transaction system would minimise the current high cost of transactions to almost zero, speed up settlement times to instant and provide total transparency. The delays caused by the absence of a globally recognised verifiable digital identity can all be streamlined by access to reliable, accurate data such as the Legal Entity Identifier database. The LEI helps identify debtors and creditors in transactions quickly, easily and reliably. In a recent interview, Merlin Dowse of J.P Morgan stated “Corporates have to connect with multiple providers, each of which issues them with a client reference number that is meaningless outside of that provider’s system. Every time they interact with a third party, they have to share their information again. Reducing all of this to one unique identifier in the shape of the LEI allows for interoperability across networks and removes friction, saving time and costs.” Were a CBDC ecosystem to adopt the LEI as its KYC layer, counterparties and regulators would have realtime access to total transparency of who is transacting, and moreover, have access to information regarding the organisational structure provided by 'Level 2' LEI data. It would work similarly to the way the IBAN currently functions, except it links to a publicly accessible database containing vital reference data on the account owner. One of the foremost problems a global financial system based on CBDCs would solve is the liberation of capital held up in reserve by Nostro-Vostro accounts. Real-time settlement of funds cross borders would invalidate the need for such accounts, and that capital would be freed up releasing over $30 trillion USD back into circulation globally. The LEI or vLEI and CBDC combination will not just speed up the authorising of payments, but rapidly increase settlement and reconciliation time of international payments. This combination also will massively enhance AML due diligence process, especially if the vLEI is to deliver on its right to represent verification feature. This will reduce fraud, money-laundering and overall risk exposure. CBDCs using the LEI as a KYC layer harness the benefits of cryptocurrencies, blockchain and distributed ledger technology, while mitigating the downsides they present to a normal, healthy functional banking system. We have already made progress towards this end as GLEIF are signed up to the latest standards in real time settlement of cross borders transactions 'ISO 20022', which is set to be followed by CBDCs or any other innovative method of transacting that may come along in this exciting new era of change. Struggling to manage and match in-house data with LEI data?

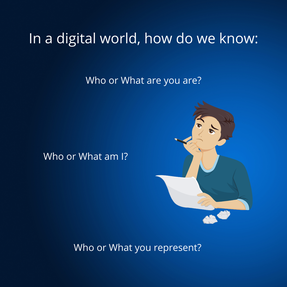

LEI Smart Matching

Conduct an LEI Check Up or LEI AuditAn LEI audit is an annual checkup for your data Just like a yearly car service provides insights into your motors health, an LEI audit offers insights into the health (i.e., accuracy) of your legal entity data.

Like a car service, an audit consists of diagnostic tests and procedures to determine if everything’s okay with your data. An LEI audit not only detects problems, but it also corrects them. The 20 character LEI ID is static, but the data it references changes. Events such as: ❗️merger, acquisition, bankruptcy or dissolution ❗️legal name change ❗️address or jurisdiction change ❗️overdue renewals of your firm’s own LEIs These all result in critical LEI data updates. Not updating your in-house data to reflect these changes will lead to operational errors and the submission of inaccurate transaction reports to regulators. This can lead to fines or financial penalties. In the case of managing LEI data correctly an ounce of prevention is worth more than a pound of cure. An LEI audit typically pays for itself several times over and gives you one less thing to worry about.

▶ National competent authorities are expected to apply these revised Guidelines from July 1st 2022 ▶ You can view existing and the original 2014 EIOPA guidelines here. The LEI is a 20 digit unique ID code proposed by the Financial Stability Board (FSB) and endorsed by G20 at the 2012 summit. The purpose of the LEI is to provide a stadardised, global identification of companies participating in financial transactions.

In accordance with Article 16(3) of the Regulation (EU) 1094/2010, EIOPA issues guidelines and updates addressed to the competent authorities and financial institutions to establish consistent, efficient and effective supervisory practices, while ensuring the common, uniform and consistent application of the law. The LEI was introduced in 2012 and EIOP Guidelines were first used in October 2014. From then up to 2010, EIOPA have issued multiple updates to its guidelines.

The new guidelines go into effect from July 1st 2022. The updates contain broader use of the LEI in comparison the 2019 update. On top of insurance and reinsurance undertakings and Institutions for Occupational Retirement Provision, now relevant branches and intermediaries operating internationally are now included. The Legal Entity Identifier system can play its role in easing the current global Supply Chain disruptionIt is not uncommon for many businesses to experience unplanned supply chain disruptions. Traditionally, bad weather and natural disasters were the main culprits, however, other issues were at fault on occasion also. Since 2020 we experienced a new entrant, COVID-19; which caused major havoc for companies on a global scale in relation to their supply chain distribution. Precipitated by the COVID-19 pandemic and industry shut downs, recent supply chain delays have caused once again a rise in popularity in cargo shipping. We recently discussed the benefit of the LEI to the cargo shipping industry.

This includes bottlenecks and cargo build-ups at ports and warehouses, causing fears of “empty shelves” across the UK and US. The pandemic has brought many things to light, including the fragility of the global supply chain. How can the Legal Entity Identifier play its role in easing the current difficulties with global supply chains

By utilizing the free, publicly accessible LEI database for supply chain visibility we can reduce complexity and achieve a higher operating profit than those who do not have a proper tracking system in place. Trust.Another issue highlighted by the pandemic is a core fundamental principle to international trade; trust. Trusting that a supplier located on the other side of the world is who they say they are. With many digital fraudsters seizing the opportunity presented by high volumes of demand for goods such as PPE in a global pandemic, we witnessed increasing levels of intricate scams and fake businesses, all of which cast doubt on the global economic landscape and burden financial institutions with delays and setbacks. The current system used in 'supply chain identification' is overly complex, fraught with risk and sometimes inconsistent data. For example, a survey conducted by GLEIF highlighted that 50% of financial institutions use approximately 4 identifiers to identify corporate clients. By using the LEI we can more easily identify would-be fraudsters and bring an extra layer of uniformity to the industry. According to the GLEIF, the LEI system offers: ✅ One universal digital identity ✅ Instant identity verification ✅ Verified company info ✅ High-quality data ✅ Open & free of charge data This means the LEI is in a unique position to be the single trusted identifier for all entities not just in the supply chain, but globally.

The can therefore play its role by consolidating a fragmented global identification system, easing blockages, time costs, and shortening delays in the global supply chain. The Bank of International Settlements (BIS) compare the standardization power of the LEI to that of the standardization of the shipping container and the economic advantages that came with it. The paper written by Francis Gross alludes to the fact that making basic micro-data freely available on participants in a marketplace would have huge benefits to the wider economy, but must be i) globally standardised, ii) real time and iii) must be granular. These are the three key characteristics which make up the global LEI system.

The Legal Entity Identifier has previously been compared to shipping containers in a 2014 Forbes article by Tom Groenfeldt “When shipping containers were first introduced, they came in a variety of shapes and sizes, so it was difficult to transport and store them. A public-private partnership led to the development of the standard 20- and 40-foot containers. The introduction of the Legal Entity Identifier (LEI) system offers a global system to identify legal entities. The primary benefit of the LEI system comes from its KYC (know your customer) applications. The ability to identify and aggregate all the existing and potential clients inside corporate systems that brings big benefits to many entities. This includes when dealing with a customer thousands of Kilometres away such as a supplier of cargo ships or potential client looking to use your services. “It is the only open, standardized and regulatory-endorsed system capable of establishing digitized trust between all legal entities, everywhere” - GLEI Other benefits of the Legal Entity Identifier System Include: 1. It is Unique: The Legal Entity Identifier system architecture assumes that only one LEI can be assigned to a legal entity. It assumes LEIs cannot be reused, duplicated and are annually renewed. 2. Reduce Risk: The LEI system can reduce risk associated with financial transactions because you are more able to assess the situation and make informed decisions. 3. Reduce Onboarding Costs: LEIs can reduce onboarding costs by 10%, resulting in an overall reduction in capital market operating costs. McKinsey recently published a study claiming that broader adoption of the LEI would save the global banking sector between 2-4 billion USD annually. 4. Promote Transparency in the Marketplace: By registering for an LEI, you’re making a commitment to promoting transparency within the global marketplace and improving your own credibility. The LEI system is destined to become the global standard for the unique identification of legal entities across the global financial sector and beyond. How to get an LEI Code:LEI Worldwide have been providing LEIs globally since 2017. With global coverage, LEI Worldwide can have an LEI code issued to you within hours regardless of your jurisdiction or entity type.

LEI Worldwide allow you to get your LEI Number hassle free and no need to even register an account. To receive confirmation of your new LEI number in the fastest, most secure way possible complete the 5 minute LEI application form here. The European Commission have announced a long-awaited AML Package and new regulatory body to govern its implementation and compliance. The Legal Entity Identifier is chosen as a trusted means to identify counterparties to transactions. The European Commission have announced the long-awaited AML Package and new regulatory body to govern its implementation and compliance.

The package put forth aims to put in place a new watchdog called the EU AML Authority (AMLA) and draft a new single EU Rulebook for AML/CFT obligations. A new EU regulatory watchdog has been proposed in order to ensure the private sector correctly and consistently applies EU AML rules. In a bid to fight money-laundering, so called "dirty money" and counter terrorism financing, the ambitious package of legislative proposals is set to strengthen the existing EU’s AML and countering the financing of terrorism (CFT) rules. The overall aim of this package is to improve detection of suspicious activities and transactions, and tighten up and loose spots in the system. For example, there is set to be an EU wide limit of €10,000 of large cash payments as this is the single most common way for criminals to launder money. In addition, the use of crypto-anonymous wallets will be prohibited, similarly to anonymous bank accounts. The Legal Entity Identifier will greatly help reconcile payments between counterparties in transactions and help flag any suspicious trends or activity. The LEI is quickly becoming the mark of trust in the global financial system. The proposal put forward on 20th July 2021 is set to include a revision of the 2015 Regulation on Transfers of Funds. Within which is a proposal for a new law which allows authorities combat AML/CFT by tracing sources of funds, or "crypto-assets". In order to achieve this the EU will mandate the use of the Legal Entity Identifier (LEI) for both payer and payees. The proposal states "(the LEI)could easily be included in existing payment message formats". This could indicate the LEI is set to overtake, or bolster the IBAN as a primary means of identifying the entities behind bank transactions on a corporate, rather than individual level. To find out more about the new package put forward by the European Commission, check out the link provided to the page on the EC website: Anti-money laundering and countering the financing of terrorism legislative package. LEI RBI GuidelinesThe LEI has been required in India since 2017 in order to increase market transparency and identify fraud in the financial transactions. All financial borrowers and lenders in India have been mandated to obtain an LEI. According to the RBI (Reserve Bank of India) the LEI has been introduced in a phased approach for market participants in the over the counter (OTC) derivative and non-derivative markets as also for large corporate borrowers.

The LEI in India has also been introduced for all payments/transactions of value ₹50 crore and above undertaken by organisations/corporates using Reserve Bank-run Centralised Payment Systems viz. Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT). The RBI states that its members should prepare for the phased rollout of the LEI, in particular those who engage in large value transactions (+₹50 crore) and those who use payment messages such as NEFTS & RTGS. RTGS: The LEI shall be reported in the ‘Remittance information’ field. NEFTS: For outward debit messages, LEI information shall be provided in ‘Sender to Receiver Information’ field. Companies in India may apply for a Legal Entity Identifier through an agent such as LEI Worldwide. Existing LEI codes may be transferred to LEI Worldwide for management and maintenance. You can find more information from the RBI on their dedicated webpage notification here: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=12010&Mode=0 Please click Register LEI in India below to obtain a new LEI, or click Transfer LEI to begin to move your existing LEI to LEI Worldwide. Global B2B Identification: Why the LEI is keyWe live in an increasingly digital age, digital processes and transactions effect, influence and monitor us on a daily basis. We use digital devices to communicate, transact, authenticate, visualise and record with devices located globally via the Internet. All of this occurs with limited thought or consideration, except perhaps the authentication of our identity. Our social standing and the media we create can provide an online identity for us but this has proven or be vulnerable to misrepresentation or straight up fraud. A proven identity is definitely something we value as we know the implications of having an identity that is considered to be proven. In order to obtain a National ID or passport, one must pass certain validity checks and when a passport is presented we can be confident this person is who they say they are. So think about a business, how can they TRUST your digital identity? Currently for a financial institution, identifying a new user digitally, quickly and correctly is a time consuming process with potential risks. Current KYC methods are considered time consuming, clunky and out dated.

You understand this and you comply or you know that you will not gain access. Therefore digital identity is already everywhere and we use it everyday. Big Tech firms have identification requirements for all of us, but the issue is when it comes to identifying a business there is no common settled upon global standard, no one access ID, or rule that governs all. The technology is available but it's not seamless across platforms yet... so we are in a state of identity segregation. The biggest hurdles seem to be adoption rates and trust. A Global Solution to business IDs: LEI SystemThe solution was created after the financial crisis in 2008 when firms and regulators had difficulty tracing and establishing participants in financial transactions in organisations such as AIG and Bear Stearns. The SOLUTION is called the LEI - Legal Entity Identifier. Known as the Global LEI System (GLEIS) which has a governance framework in place recognised by the G20 forum which contains the major economies from around the Globe. The LEI is: • 20-digit, alpha-numeric code based on the ISO 17442 standard. • Designed to be used and recognised globally. • Identifier for legal entities involved in digital transactions. • Decentralized and used in an open data system that allows its identification data to be accessed by anyone. • Incorporates in-depth validation services in each part of its process.

Digital ChangeThe digitisation of all kinds of personal and organizational activities has accelerated, driven in no small part by the pandemic and the pace of technological change required. This digital transformation has enabled new business approaches, created new businesses and redefined how organizations connect and engage with one another. As a result more processes and interactions are also making the switch to digital, and stakeholders are having to work harder than ever to classify, identify and verify their businesses. As a result, digital identity management has never been more important for business and is vital for their future to perform on a global level. Businesses without efficient and validated digital identity management encounter business costs in labour and time. This is without mentioning the risk of bad customer interactions, fraud and incorrect data leading to unforeseen costs. McKinsey have conducted independent research and concluded global adoption of the LEI system would save the global banking sector between $2-4 billion annually. Why the LEI Code is the Digital Identity Future for Business Today, different digital ID systems are based on varying certification and technological standards, keys and encryption and the only common link between them is the entity name, which can vary widely and as mentioned can change over time. The LEI is the solution as it provides the ability to rethink customer relationships by having an inbuilt trust solution that is verified enabling determination of who’s who removing related costs and inconvenience and pure frustration of manual processing. A universal solution that provides a unique id that does not require the stakeholder to be locked in and can be easily updated. An LEI provides: • Regulatory endorsement • Standardisation • Recognised legal identifier • Based on open data As LEI’s are used currently in the public and private sectors, in the digital age its proven to be of great value for regulation and business. The system is already is improving customer onboarding, communication and verification and this is only the start of its use. LEI can provide a fast and simple way to ensure the information obtained through digital certificates is suitably reliable, current and verifiable. The LEI can become an essential building block for the usage of digital certificates and digital signatures. Quarter 2: 2021The Global Legal Entity Identifier Foundation (GLEIF) welcomed the first commercial demonstration of LEIs embedded within digital certificates by the China Financial Certification Authority (CFCA). Stephan Wolf, CEO of GLEIF commented: This progress by CFCA on both fronts is very welcome as it moves us one step closer to broad LEI usage in digital certificates globally. Realizing the goal of universal LEI usage in digital identity products will be an important step in enhancing trust and creating innovation opportunities across private sector digital identity management applications. LEI being an ISO 17442 standard, linking back to a datafile in GLEIF that is publicly available answers the question who is who and who owns whom for ALL stakeholders NOW and in the FUTURE.

Establishing your legal identity digitally and it being trustworthy has become a foundational requirement for digital life to enable the determination of 'who's who' within any digital community to validate interactions of any kind social, financial or business. The VITAL role to be played by Digital identity and the LEI in the future of global business cannot be overstated.

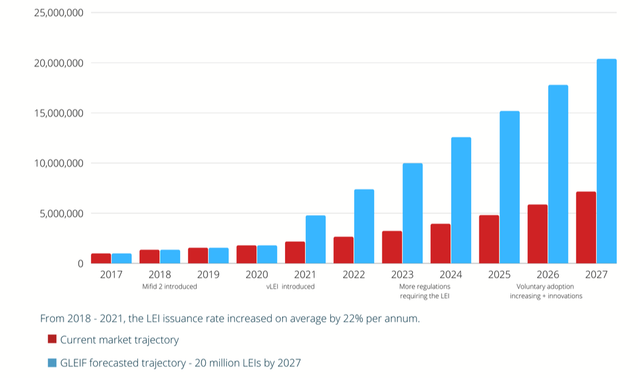

By 2027, GLEIF aims to grow the LEI population to over 20 million thus enabling that the LEI, as a broad public good, will generate most value when reaching a critical mass. - Minutes GLEIF Board of Directors Meeting, Oct 2020

It is clear from the chart below that with the current market growth trajectory this will not be attained, and if current growth rates are continued we will have somewhere around 7 million LEIs by 2021.

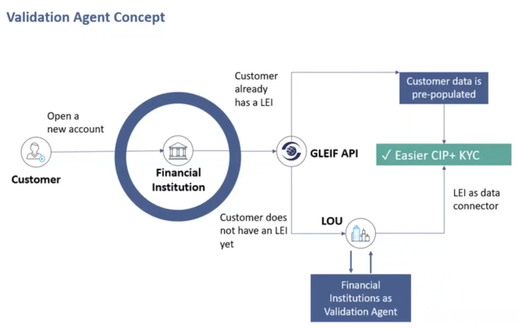

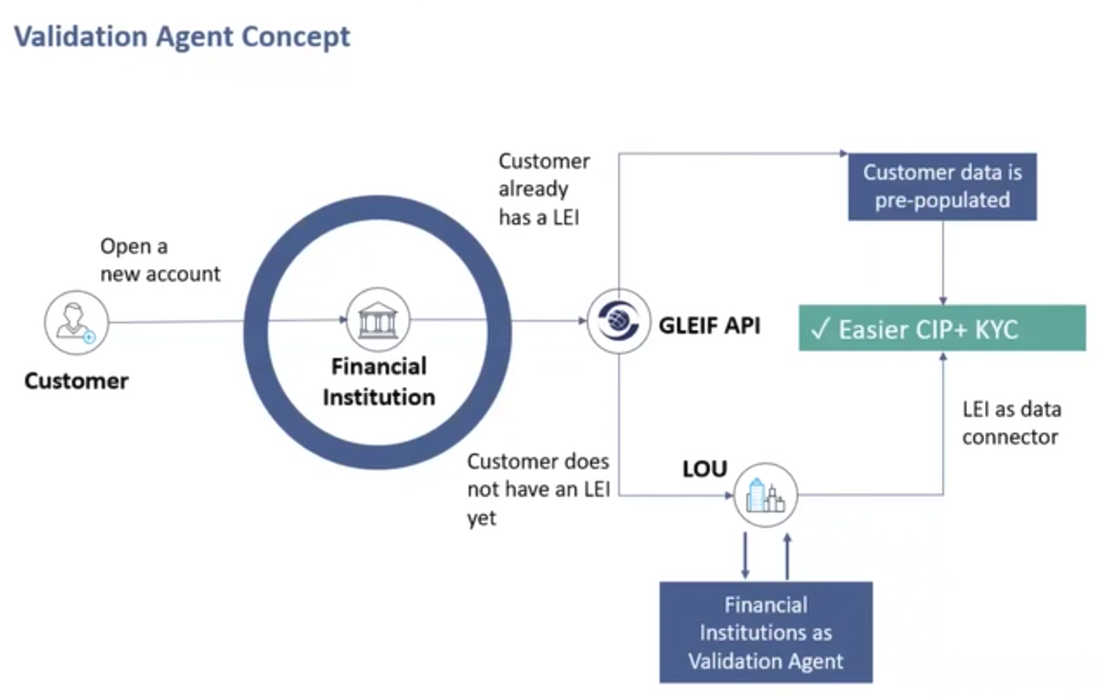

Enter the LEI Validation Agent Framework

Until now, legal entities have been going through regular onboarding and due diligence protocols when doing business with a Financial Institution such as an Investment Bank. At some point the Financial Institution anticipates the entity will need an LEI for a particular trade or investment activity and prompts the entity to apply with one of the LOUs or with a registration agent such as LEI Worldwide.

The legal entity then goes through a very similar process when applying for the LEI, and going through a very similar process in order to obtain the LEI. This duplicate process creates unnecessary work for the LOU and the entity can be validated at source before having an LEI issued to the by a partner LEI provider such as an LOU or a Registration Agent.

So, by effectively minimizing overall workload by streamlining the process, we can reduce the overall cost of the LEI and increase the LEI adoption rate simultaneously by making them cheaper, more accessible and easier to issue.

The GLEIF Validation Agent Framework leverages existing KYC & AML workflows in order to simplify the LEI issuance process and reduce the workload shared between Financial Institutions, their clients requiring LEIs and LEI service providers" - Darragh Hayes, Director, LEI Worldwide

Since the LEI VA Framework was introduced in September 2020 J.P. Morgan have become the first Financial Institution to sign up to the GLEIF Validation Agent program. Find out more here

Working as a validation agent will allow us to improve our client onboarding experience as well as create valuable industry LEI reference data" - George Brandman, Managing Director, J.P Morgan” How to become an LEI Validation Agent

A Financial Institution that wishes to become a Validation Agent can do so by partnering with LEI Worldwide.

We are currently engaging Financial Institutions in this process and developing our API based system to allow Financial Institutions become Validation Agents with access to LEIs for their clients with global coverage. There are many benefits in partnering with a Registration Agent for the LEI VA program. Once the LEI issuance is complete, what then? LEI Worldwide’s fit-for-purpose LEI management system is designed for Validation Agents to easily handle large portfolios of LEIs.

Benefits of partnering with a Registration Agent:

Get in touch today to find out how we can help you to take part in the Validation Agent programme and begin offering your clients Compliance-as-a-Service (CaaS) with the help of an experienced and capable LEI partner.

Extra Viewing: GFMA Webinar feat. GLEIF “The Evolution of LEI: Innovation to Support Financial Markets”

The future of global monetary policy, Crypto and how the LEI system can play a major roleThe way we conduct business on a global scale is becoming ever more digitised. This intensifies the need for more robust and standardised security around digital identity and transparency when it comes to financial transactions and sending money abroad. This includes the need for regulators to custody their respective markets and ensure fairplay, and also provide the participants in each market to have sufficient, reliable and standardised data on who they are doing business with. With the ongoing complications brought on by the COVID-19 pandemic, we have seen how the current global financial system has room for improvement, and how the Legal Entity Identifier can help fill these gaps.

These delays can all be streamlined by access to reliable data such as the Legal Entity Identifier database. The LEI helps identify debtors and creditors in transactions quickly, easily and reliably.

In the physical world we would never consider a SWIFT transaction to an unverified entity. We would have regulatory compliance, KYC protocols, verification processes and credential validation. Perhaps even a custody and clearing service! Yet Cryptocurrency, with its anonymity focus is now a MAJOR focus of Institutional investors and in order for it to be accepted more broadly as a utility, it needs regulatory clarity, and efficient KYC processes. Cryptocurrency ‘institutional investor interest is growing at pace.’ WHY? Cryptocurrency has the inbuilt advantages of:

Cryptocurrency is a global digital currency that is secured by cryptography. It is also usually not tied to any Government or central authority meaning it has a decentralised control system. This is normally a distributed ledger technology, called a Blockchain.” Blockchain and the LEI

While the transaction records of cryptocurrencies like Bitcoin can be viewed by anyone with the address details, they do not require a real world identity to be provided. This means that the transactions can be anonymous and untraceable to the participants in the transaction.

Neutral bridge assets such as a blockchain based currency would enable seamless currency movement between various Central Banks without requiring each one to load pre-funded accounts often required in cross-border transactions. An on-Demand Liquidity service would allow financial institutions to transact in instantly on a global scale, using a digital asset as a bridge currency. A will create faster, cheaper, and more efficient payment infrastructures with lower failure rates; greater competition and access to global markets; increased access to financial services for unbanked populations; and government sovereignty over monetary policy. The LEI solution was created after the financial crisis in 2008 when firms and regulators had difficulty tracing and establishing participants in financial transactions in organisations such as AIG and Bear Stearns. A 20-digit, alpha-numeric code based on the ISO 17442 standard. The LEI is a unique legal entity reference number enabling identification of legal entities participating in financial transactions GLOBALLY. Providing a standardized framework that enables accuracy and reliability in a global financial system for all the market participants. The use of the LEI for fully distributed verifiable credentials provides a missing capability in distributed identity. The value extends far beyond financial services to e-commerce, trade services, and governmental reporting. The LEI in this way reinforces the value the ISO 17442 standard as the world of organizational identity in the digital world evolves.” LEI usage is already providing firms with the ability to improve transparency, risk management and regulatory compliance. According to a report by McKinsey, the wider use of Legal Entity Identifiers (LEIs) across the global banking sector could save the industry $2-4 billion USD annually. In April 2019, the Global Legal Entity Identifier Foundation (GLEIF) and the Association of National Numbering Agencies (ANNA) piloted the first daily open-source relationship files that link newly issued International Securities Identification Numbers (ISINs) and Legal Entity Identifiers (LEIs). With a universally recognized digital identifier, this would further help cater to the demands of exchanges, regulators, service providers, and custodians. The ISIN to LEI would facilitate clearing and settlement of securities and payment processing during the issue of a specific security. The linking of ISINs and LEIs was endorsed by regulators, including the Financial Stability Board (FSB) and the European Securities and Markets Authority (ESMA). NNA's such as Tokyo Stock Exchange ,London Stock Exchange, CUSIP Global Services continue to join the ISIN to LEI Mapping Initiative. The daily ISIN-to-LEI relationship files, are publicly available on the GLEIF website, and include new ISINs issued by national numbering agencies (NNAs). Volumes of ISIN-to-LEI coverage have grown to over 5.2m active ISINs linked to almost 72,000 unique LEIs. Could all this mean that a cryptocurrency based financial system becomes the de facto money transfer system replacing SWIFT? It certainly is a conversation being had within the major financial authorities around the world at the moment. A digital LEI system would provide the following benefits to such a system:

LEI Worldwide could play a major role in this transition by providing and managing Legal Entity Identifiers to the market participants engaging in these transactions.

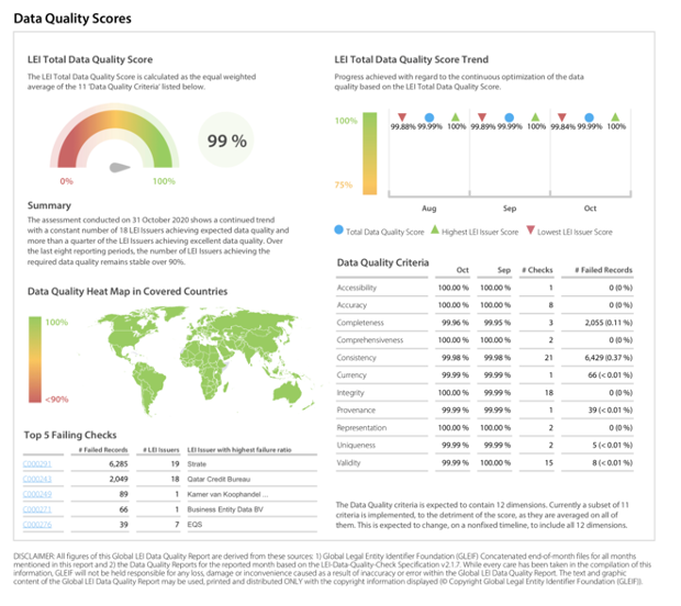

LEI Worldwide is seeking partnerships with Globally Important Financial Institutions such as banks to help them become Validation Agents as a part of GLEIFs new VA programme, offering management to their LEI portfolios and ensuring timely renewals, a streamlined registration process through the use of APIs and access to a fit for purpose LEI management system. The new LEI Conformity Flag will enhance universal trust in LEI dataThe new LEI Conformity Flag was introduced during a webinar in April 2020. It is set to be implemented throughout 2021 and is still undergoing testing and prototyping. The quality of LEI data is of critical importance to the integrity of the global LEI system. It remains the only global legal entity identifier that publicly shows a record of when the data was last updated. The Financial Stability Board (FSB) have stated that the LEI system should promote a “higher quality and accuracy of financial data overall”. What is an LEI? The LEI is essentially an international business passport, which identifies your company and allows you to know for sure that your counterpart is who they say they are. This is why trust in the system is paramount. Currently, in order for the LEI data to be deemed trustworthy it requires annual renewal. If an LEI is allowed to ‘Lapse’ it will be marked as lapsed on the public LEI database meaning the data has not been checked in the last 12 months rendering it outdated. But if an LEI is active, how can we still be sure the data is accurate? GLEIF report 99% LEI accuracy which leaves 1% of LEIs as unsure. This is thousands of LEIs. Soon we will have the Conformity Flag to give us a second layer of data quality assurance, along with the existing LEI Status.

For example the European Central Bank constantly evaluate the data quality of the LEI, and will welcome the addition of a conformity flag which will guarantee the data quality of any specific LEI code where a flag is present. If an entity has not been awarded a flag, perhaps the data source was not trusted, maybe there is another LEI for the same entity (duplicate) or the LEI data is not consistent with other records. LEI data is public, and GLEIF issue monthly data quality reports which are generated based on 11 data quality metrics. Here is the link to the data quality reports: https://www.gleif.org/en/lei-data/gleif-data-quality-management/about-the-data-quality-reports/download-data-quality-reports/download-global-lei-data-quality-report-october-2020 Here is the most recent October 2020 report:

LEI Worldwide fully support the conformity flag project and I personally believe that when users of the database see it on an LEI record they will have assurance and trust in the system making it the single most trusted identifier for companies globally.

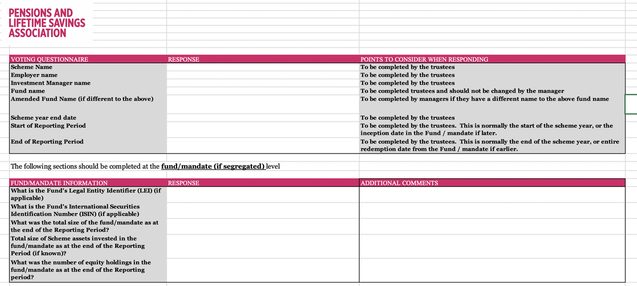

LEI Worldwide work closely with the Ubisecure team to prioritise data quality for our clients so we expect 90%+ conformity on our clients LEIs when they are reviewed, and we will review the remaining LEIs on a continual basis to maximise conformity. The United Kingdom Pensions & Lifetime Savings Association (PLSA) have directed that the trustees of UK Pension Schemes are required to complete an ESG Template. First order of business on the template?..... What is your LEI? Environmental, Social and Governance (ESG) has become more prominent in recent times with regards to financial services, pension schemes and investments. ESG policies are concerned with environmental, social and governance factors that may affect the performance of a company or asset. The PLSA are encouraging responsible investment and market participation by way of ESG reporting duties. This will force pension schemes to at least consider how they factor in the importance of ESG risks in their business decision making policies. To date, the key focus for trustees of UK Pension Schemes has been to maximise returns. However, recent rules drafted by the Department for Work and Pensions (DWP) require UK pension schemes to clarify and explain their policies surrounding ESG (including climate change) factors. The PLSA have now issued a template to UK pension scheme trustees which must be completed and filled. One of the requirements is "What is your Legal Entity Identifier?" If you are a trustee of a UK pension scheme you can find this template below. UK Pension Schemes also require an LEI for a number of other reporting regulations such as Mifid 2. Click here to find out more about LEIs for pensions schemes. Trustees should also consider the implications of the 2019 changes to the Investment Regulations, which implement the EU’s second Shareholder Rights Directive (SRD II). The second phase of SRD 2 was due in September 2020. SRD is one of many European regulations introduced after the last global recession revealed many weaknesses in the global financial system such as excessive risk taking, lack of transparency with regards to risk analysis, identification of shareholders and complex chains of intermediaries.

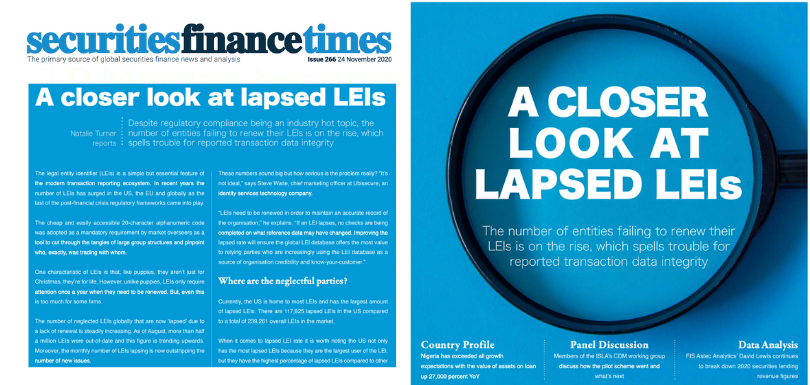

These mounting regulatory requirements mean it is becoming increasingly important for firms to have a clear policy around ESG going forward. Click here to read the PLSA guide on ESG for pension schemes and investment firms. In a recent interview conducted by the Securities Lending Times, Director of LEI Worldwide spoke with Natalie Turner and took a deeper look the current rate of Lapsed Legal Entity Identifiers globally. As roughly half a million LEI Codes are now in a state of Lapsed, meaning they have not been renewed in the last year, we discuss how this has happened, and why it is more prominent in some countries rather than others. Some of the primary reasons include LEI which were obtained for regulatory purposes, which regulations which require an LEI, but not necessarily an 'active' LEI. Another reason is management of the LEI and education on the LEI requirement in general. "Sometimes LEIs lapse because the ownership of the task to renew the LEI changes, people change roles or move on from companies frequently, especially right now in the middle of a pandemic." - Ubisecure's Steve Waite J.P Morgan has become the first validation agent in the Global LEI system. The validation agent framework which was introduced in September 2020 by The Global Legal Entity Identifier Foundation (GLEIF) in order to increase LEI adoption by accelerating client lifecycle management and reduce LEI registration costs by using existing KYC and AML techniques to replace existing entity validation steps in the LEI issuance process. J.P Morgan, in partnership with Business Entity Data B.V. (GMEI Utility a service of BED B.V.) have together issued their first LEI. The framework is based on the fact that globally important financial institutions and banks such as J.P Morgan are trusted data sources and are therefore perfectly positioned to verify their customers data to an existing LOU who may then proceed to have an LEI issued, thereby removing a time consuming but necessary step in the LEI issuance process. Working as a validation agent will allow us to improve our client onboarding experience as well as create valuable industry LEI reference data" - George Brandman, Managing Director, J.P Morgan New LEI Finder released to reduce LEI Lapsed RatesLEI Worldwide have released a new LEI Search tool which allows you to navigate the LEI index, access the global LEI database and find any Legal Entity Identifier in real time. The Securities Lending Times recently spoke with Director at LEI Worldwide about the development and the need for such a tool in the LEI market. With as much as 30 percent (500,000) of legal entity identifiers globally are out of date and in need of renewal, the LEI Checker now allows you to check the LEI status and renew your LEI instantly. The SLT article continues to say "Last week, the Commodity Futures Trading Commission fined Morgan Stanley $5 million for a range of swaps reporting failures between 2013 and 2018, including incomplete LEIs. “Upon further investigation, we realised that Morgan Stanley Capital Services had a lapsed LEI between 2013 and 2018. It is quite simple to renew the LEI, and it is possible they did not realise it had lapsed,” says Hayes.

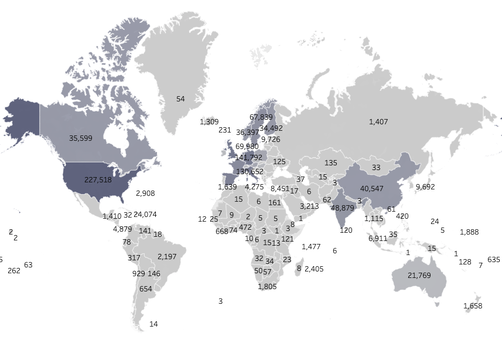

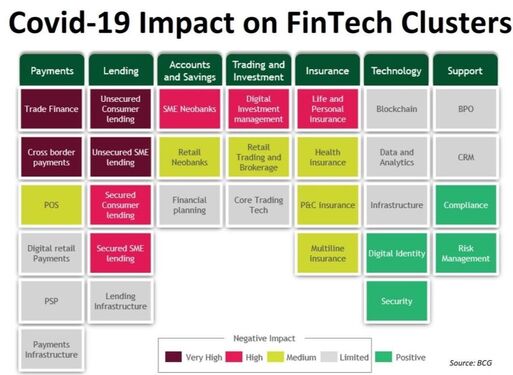

Need for securityDuring the COVID-19 pandemic we have seen a number of developments within the LEI and identity industry. Firstly, the importance of the industry has not only been increased, but the comprehensive need for a more secure digital identity became more apparent. Fraud cases have risen exponentially since the beginning of March. Online hackers are looking to take advantage of companies working from home as they struggle to adapt to lockdown and seek to implement new processes and payment procedures. Over £16m has been lost in the UK due to online shopping fraud since the onset of COVID-19. There has also been a 33% surge in attempted cases of financial fraud. The bulk of these were in the asset financing sector, an area which has already been identifier as one that can benefit greatly from adopting an LEI check as a part of their customer onboarding KYC processes. Banking is another area which can benefit greatly, as has been highlighted in recent research conducted by McKinsey. Fraudulent credit card and loan applications can be easily detected by linking the applicant to an LEI, or if one has not been yet obtained it can raise a question mark. This greater need for security can be clearly seen in the below chart. The only FinTech clusters which benefitted during lockdown were security related. IRDAI asked not to sanction loans without an LEIIn light of the above developments, some regulators and financial institutions are turning to the LEI to add an extra layer of security to their internal validation processes. The Insurance Regulatory and Development Authority (IRDAI) of India has asked insurers not to grant loan renewals or amendments if the borrowers have not been identifier by way of a Legal Entity Identifier before 30th June 2020. The IRDAI also asked the insurers to advise their corporate borrowers with a large exposure score to obtain an LEI number by mid-Summer. In a circular released by the IRDAI, the LEI Code is to be stored in their records and specify the same while reporting the transactions executed with such corporate borrowers. You can find the circular here. ING Banks develops method of identifying transactions using LEIsIn October 2018 the Financial Action Task Force expanded its AML Mandate to include VASPs. This mandate is known as the Travel Rule Protocol. The Netherlands based lender ING Bank, developed a protocol to assist with the Financial Action Task Force (FATF)'s Travel Rule, as a part of its AML mandate. This will now allow VASP (virtual asset service providers e.g Coinbase) members a way to query for the existence of address entries which will be defined by a PKI (Public Key Infrastructure) and Legal Entity Identifier (PKI). This will allow the secure tracking of digital asset transfers such as cryptocurrency. The solution has already been supported by large corporations such as Standard Chartered Bank and Fidelity Digital Assets. Malcolm Wright, head of the AML working group at Global Digital Finance suggests that the LEI (which could be used in conjunction with Mifid II) could be used when issuing a VASP code to all market participants. Please see CoinDesk for more information. GLEIF open US based officeAccording to the press release issued, they have made the move across the pond in order to increase their 'on the ground' engagement in operations in the USA, the country with 13% of all LEIs and the lions share of issued Legal Entity Identifiers. This will serve to enhance their main goal of educating industry members on the importance of the LEI System and increasing voluntary adoption rates of the Legal Entity Identifier. The initiative will be headed by Karla McKenna of GLEIF and will be joined by Peter Warms, formerly of Bloomberg. GLEIF’s new US office brings us closer to our stakeholders in this important market at this critical time. LEI issuance in the US is the highest across all countries globally, and we recognise the importance of accessible and engaged GLEIF resources on the ground to help drive LEI issuance beyond regulation. This is especially important as we seek financial institutions globally to partner with us on pilot programs, to trial wider LEI adoption and to work with us in exploring how financial services firms can become active participants in LEI management. Our move into North America sends a clear message to our banking industry stakeholders in the region: GLEIF is here to help the sector benefit from broader LEI integration across business banking lines. We are here to assist you.” - GLEIF If you would like to add an extra layer of security to your KYC process, start using the LEI search tool today. It is the perfect addition to any internal organisational process which involves identity checks. The tool is free to use and the data is global, reliable and up to date! Below, we outline why you should start using it today, and how to make the most of it. The global LEI system has innumerous benefits to the global economy. The Legal Entity Identifier provides unique, standardized data on companies trading all around the world. The most important feature of the LEI data is that it is stored in an easily accessible, public database that you can begin using, today! The GLEIF search tool is not just used by regulators, or financial institutions for reporting and compliance obligations. The beauty of the LEI is that any company can easily integrate an LEI check as part of its KYC processes. The beauty of the LEI is that your company can easily integrate an LEI check as part of its KYC processes, pretty much straight away. With over 1.7 million entities on the LEI database, you can navigate the GLEIF search tool and discover valuable information about potential clients, investors or customers.

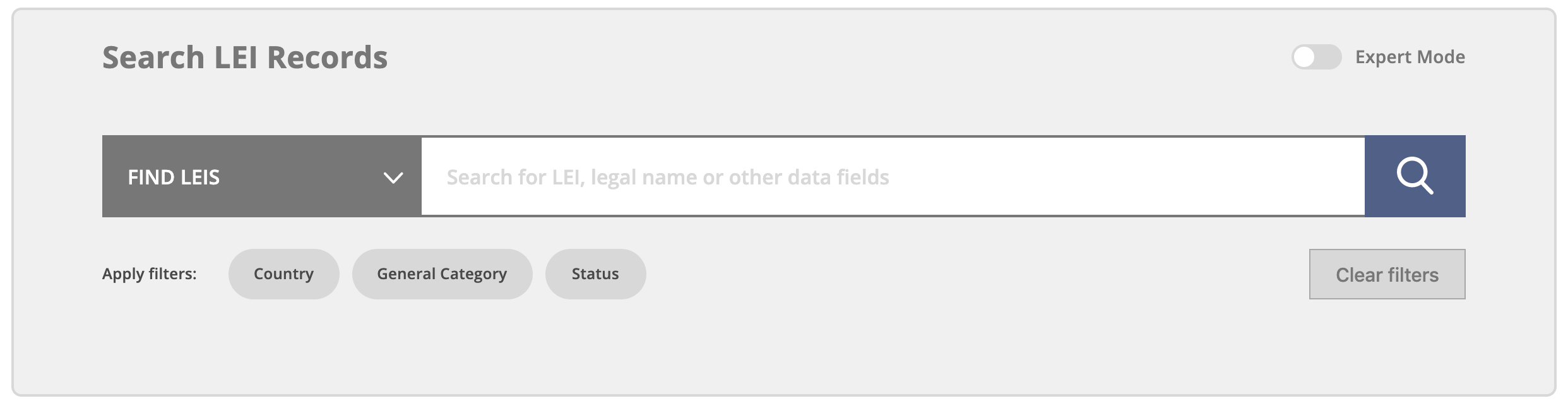

Now, when dealing with another company, checking if they have an LEI is a sure way to know they exist and are who they say they are. In many instances, the LEI checker can provide an organizational structure or parent information. For example, by looking at the LEI of Alphabet Inc, you can easily see that it owns Google and the family tree and all subsidiary entities associated with the global corporation. How can you begin using the LEI Search tool?GLEIF have made freely accessible the LEI search tool. This tool allows you to search LEI data in depth using ‘Expert Mode’. An LEI record will provide you with basic information on any given entity such as:

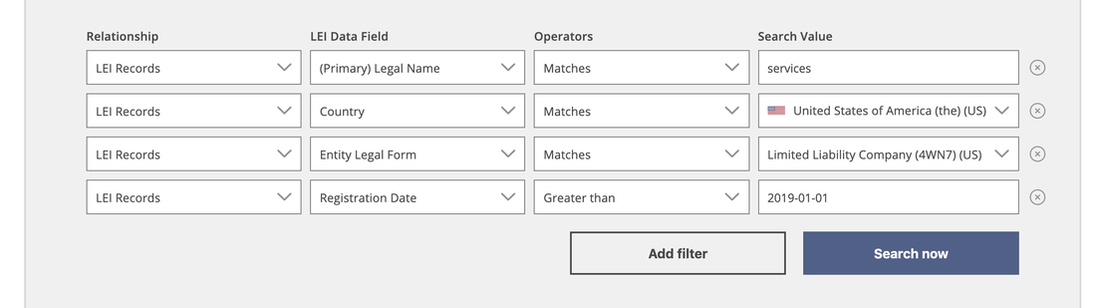

To begin your search visit the GLEIF Look Up tool (link at the bottom of this page). Think of a company you have in mind, or simply navigate the database freestyle to check it out. If your initial search does not provide your desired result, try filtering by switching on the 'Expert Mode' button in the top right corner. Using 'Expert Mode'Use expert mode to conduct a search by combining multiple search filters. We suggest playing around with this for a while until you get the hang of it.

Expert Mode filters include the below (all can be used in combination):

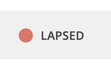

To use a random example, we will search for Limited Companies in registered since 2019 in the USA, who have the word 'services' in their name. Understanding LEI StatusYou can also view the status of the LEI code. This will tell you whether the information contained within the record is likely to be valid or up to date. If the LEI code has not been renewed recently, it may contain inaccurate data. LEI Status: ISSUED: The LEI is active, and the information on the LEI record has been updated within the last 12 months. LAPSED: The LEI has expired and the data has not been renewed. It needs to be updated. It is estimated that by adopting searches such as this, the global banking industry could save up to $2-4 Billion in KYC checks annually. The LEI Search adds a quick, and reliable extra layer of security to your current KYC processes. In summary, the LEI Search tool is a very reliable and useful database that can be introduced to your team in a matter of minutes. You can include the LEI as a requirement for customers to fill out on your forms for example. If they provide an LEI, and the data is accurate, you can have peace of mind knowing that they have accountability, are who they say they are and are a company that stand behind their brand. "No LEI, No Trade"If you have an LEI Code, we recommend that you maintain it. It should not Lapse or it could interfere with your ability to conduct business. If a potential investor sees that you have an expired LEI, it may discourage them from engaging in business with you. It could also result in your banking or financial institution blocking trades, or your regulator preventing the settlement of securities. We are here to help...LEI Search Tool LinkThe GLEIF LEI checker is the official, fastest, & most accurate way to check on the current status of any LEI. Global financial markets are in turmoil with the closing of businesses brought on by the COVID-19 crisis. Usually, a terrible situation such as this would inevitably lead to a severe economic downturn. This is the case during and after this pandemic, moreover, we are now made confront another fact; global monetary policy over the last decade and how this effect by an economic downturn. Since the Global Financial Crisis of 2008, central banks throughout the world such as the Federal Reserve, the European Central Bank (ECB) and the Bank of England utilised ever-increasing Quantitative Easing (QE) systems as a means to securing the the global economy against threats. These systems brought about an upturn in the global money supply, a huge reduction in interest rates and protected financial institutions from the looming threat they would otherwise be facing due to becoming over-leveraged. At a glance, the global economy recovered as businesses picked up the broken parts and began again, boosted by increased access to low interest rates and cheaper money. At a policy level the central banks, reduced interest rates to almost zero. This resulted in basically disarming themselves of the weapons they would require as a means to protect against oncoming economic volatility. Moreover, the problem that was caused by over-leveraging financial institutions led to the 2008 disaster not only remained unpacked, but was enhanced. The main problem which remained underlying therefore grew in the background, awaiting a trigger to unleash its wrath. That trigger is COVID-19. COVID-19, also known as Coronavirus, is an infectious disease caused by a new type of corona virus originating in animals. The disease causes respiratory illness (like the flu) with symptoms such as a cough, fever, and in more severe cases, difficulty breathing. At present, the world is still reeling from the direct effects of the last economic crisis. The real economy and has not yet come to terms with the economic storm that will be unleashed hereafter. There is however, a silver lining. Following the collapse of Lehman Bros in 2008, the G20 initiated a global ISO standard that increased transparency in global financial markets; the Legal Entity Identifier (LEI). This identifier serves as a passport number for companies operating internationally, identifying the exact legal entity and its ownership structure, thus avoiding the confusion that reigned in 2008 when financial institutions had difficulty ascertaining their counterparty exposure in a time of economic volatility. Regulators throughout the world have recognised the utility of the LEI as the pre-eminent identifier and a multitude of regulatory reporting mechanisms throughout the world now require an LEI. Indeed under MiFID II, the EU mandate has been described as "No LEI, No Trade". Today, LEIs are also being matched with International Securities Identification Numbers (ISINs), rendering increased transparency for market participants by identifying the financial instruments issued by individual companies. The world is currently facing unprecedented challenges. While peoples' health must be at the forefront of these, the financial well-being of the global system remains a critical priority. At this time, the real utility of the LEI in delivering transparency to opaque markets will undoubtedly come to the fore. Order your LEI now or contact us today to find out more.

|

LEI WorldwideThe views expressed in this blog belong to LEI Worldwide. Archives

April 2022

Categories |

Facilitating the global allocation of LEI numbers.

LEI Worldwide facilitate entity identification in the global financial system, capital markets and private sector. We make the process accessible and simple for Legal Entities to obtain Legal Entity Identifier numbers. By doing this we help facilitate the global allocation of LEI numbers. It is our mission to be the one point of contact globally between Legal Entities & LOU’s and ensuring the LEI becomes the Worlds most important identifier.

Services |

Company |

|

UNITED STATES | DUBAI | GERMANY | NETHERLANDS | UNITED KINGDOM | AUSTRALIA | BRAZIL | CANADA | FRANCE | SPAIN | HONG KONG | CHINA | INDIA | ITALY | SWEDEN | BVI | MALTA | UNITED ARAB EMIRATES | MEXICO LUXEMBOURG | SOUTH AFRICA | BELGIUM | SINGAPORE | JAPAN | MAURITIUS | CAYMAN ISLANDS | TURKEY | PORTUGAL | PANAMA | DENMARK | CYPRUS | KENYA | IRELAND | NEW ZEALAND | GREECE | SEYCHELLES

RSS Feed

RSS Feed